For decades, the term “Liquidity Trap” belonged to the world of macroeconomics—a scenario where rock-bottom interest rates fail to stimulate growth because everyone is hoarding cash. But as we move through 2026, a new, more technical version of this trap has emerged within the plumbing of global finance.

As institutional demand for intraday liquidity skyrockets, the industry is reaching a tipping point. The transition from static to real-time collateral management is no longer a “nice-to-have” digital transformation project; it is a survival requirement. By leveraging tokenization, programmable smart contracts, and unified API ledgers, the financial world is finally learning how to melt these frozen pools of capital.

The 2026 Dilemma: Why the “Trap” is Structural

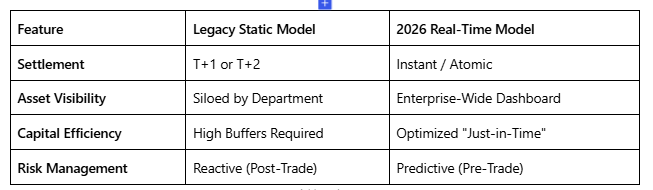

Historically, a liquidity trap was defined by consumers hoarding cash. In 2026, the trap is operational. Our financial ecosystem is moving toward T+0 settlement and real-time payments (via UPI and CBDC-W), yet our collateral remains locked in legacy, “static” silos.

- The “Idle Asset” Tax: Thousands of crores in high-quality liquid assets (HQLA) sit idle because valuation and movement happen in batches, not beats.

- The LCR Squeeze: New RBI regulations effective April 1, 2026, mandate stricter haircuts on Level 1 HQLA. This means banks must work their assets harder just to maintain the same Liquidity Coverage Ratio (LCR).

- Operational Friction: In a volatile market, the time lag between a margin call and the mobilization of collateral is no longer just an inefficiency—it’s a systemic risk.

The Pivot: From Static to Real-Time Collateral

To break the trap, we must shift the institutional mindset. Collateral should no longer be viewed as a “back-office safety net” but as a strategic liquidity engine.

1. Tokenization of Real-World Assets (RWAs)

The RBI’s Unified Markets Interface (UMI) has paved the way. By tokenizing Government Securities (G-Secs) and even corporate debt, banks can move “fractions” of collateral instantly.

Strategic Edge: Tokenized collateral allows for intraday liquidity—allowing you to borrow for three hours rather than twenty-four, significantly lowering funding costs.

2. AI-Driven Inventory Optimization

With “Agentic AI” moving from pilot to production in 2026, banks are now using autonomous agents to scan global and domestic inventory in real-time. These systems automatically select the “cheapest to deliver” asset for any given margin requirement.

3. Real-Time Valuation & Margin Calls

Static daily marks are being replaced by streaming valuations. For NBFCs and private banks, this means the ability to release collateral the moment market moves in their favor, rather than waiting for the end-of-day (EOD) cycle.

The Competitive Advantage for Indian Banks

India is uniquely positioned to lead this shift. With the Digital Rupee (Wholesale CBDC) maturing, the “atomic settlement” of collateral—where the asset and the payment swap simultaneously—is now a reality.

The Mandate

We must collaborate to:

- Dismantle Silos: Consolidate collateral held across derivatives, repo, and SLR desks.

- Invest in API-First Infrastructure: Ensure your core banking system can “talk” to external tokenization platforms and the RBI’s UMI.

- Re-evaluate Haircuts: Use real-time data to negotiate better terms with counterparties, proving the high quality and mobility of your digital assets.

Escaping the Trap: The Strategic Path Forward

The 2026 Reality: In a high-speed market, the most asset isn’t just the one with the highest rating—it’s the one that is most mobile.

This is where ECLMS becomes the mission-critical infrastructure for the modern bank. By providing a single source of truth for all customer credit data and real-time exposure tracking, ECLMS doesn’t just manage collateral—it unlocks it. It automates the entire lifecycle from onboarding to revaluation and release, ensuring that your capital is never “trapped,” but always optimized.